Sensitive data: Tips for protecting your information

How to protect personal and financial data in the digital world from fraud and identity theft?

In today's digital world, protecting personal and financial data is critical to avoiding fraud, identity theft, and cyber-attacks. Fraudsters and criminals use various methods to gain access to your sensitive information, so it's important to understand what data you should never share, especially online or with unknown sources.

What is sensitive data?

Sensitive data is information that, if in the wrong hands, can be used to commit financial fraud, steal your identity, or jeopardize your personal safety. Some of the data includes the following:

Bank account or credit card number

This is some of the most valuable data for criminals. They could use your credit card or account number to conduct unauthorized transactions or steal money from your account.

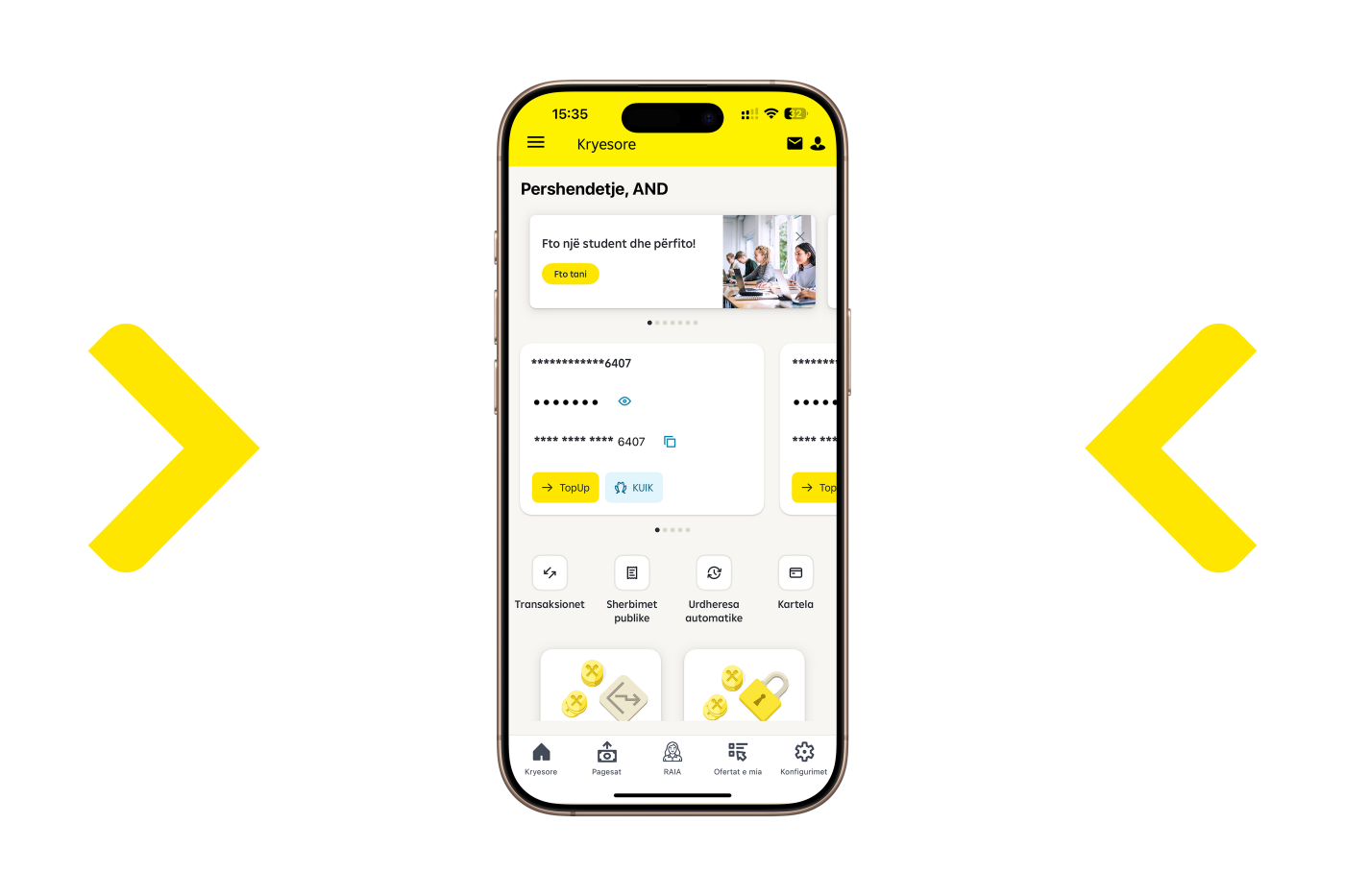

Online bank account information, which is used to access and transfer funds, and credit card information, can allow for unauthorized purchases and fraud.

PIN or passwords

A PIN (Personal Identification Number), also known as a password, grants access to your personal and financial accounts, among other services. Criminals can use these to gain control of your accounts and carry out fraudulent activities.

Personal documents (ID, passport)

Copies of your ID, passport or driver's license contain important information that can be used for identity theft or other fraud.

Home address and telephone number

Although this information seems less sensitive, it can be used by fraudsters to trick you or launch other attacks, such as smishing or vishing, where they try to obtain more sensitive information.

How to protect your sensitive data?

- Don't share with unknown sources: Never share sensitive data via email, unsecured messages, or over the phone with people you don't know or are not sure if they represent a trusted institution.

- Use two-factor authentication (2FA): Always enable two-factor authentication for important accounts to add an extra layer of security beyond the password.

- Store passwords securely: Use strong and unique passwords for each account, and avoid using the same password on different services. \Use a password manager to keep them safe.Use secure networks: When carrying out financial transactions or providing sensitive information online, be sure to use secure networks (not public or unsecured networks).

- Beware of phishing and online scams: Don't click on links or emails that ask for sensitive data, especially if they come from unknown sources or seem suspicious.

Protecting sensitive data is essential to maintaining your financial and personal security. By being careful and implementing best practices for data storage, you can avoid fraud and keep your data safe. Remember, never share sensitive information without first verifying the credibility of the person asking you for this information.

Please be aware that our official communication channels are only through phone numbers: 038/222-222 and 049/222-222, as well as through our official domain: raiffeisen-kosovo.com.

If you receive any calls, messages, or emails that appear to come from these numbers or from our domain, but you have doubts about their authenticity, please stop communicating immediately and do not share any personal or sensitive information and notify us immediately.