TREASURY BILLS More opportunities for safer investments

Diversifying my investment portfolio is the key factor in my financial strategy to increase the value of my wealth. In my list of investments, treasury bills and government bonds have a special place. These investments are considered to be safe opportunities as they are issued by the Government of the Republic of Kosovo with an additional guarantee.

Through Raiffeisen Bank, I am provided with the opportunity to participate in the auctions of Treasury Bills and Government Bonds issued by the Government of the Republic of Kosovo. Treasury Bills are short-term securities that mature (end) in less than one year from the date of their release on the market, while Government Bonds are long-term securities that mature in a term longer than one year.

Treasury Bills with maturities of 3, 6, and 12 months

Government Bonds with a maturity of 2–7 years

How can I purchase Treasury Bills?

Treasury Bills are issued (put up for sale) by the Government through an auction.

- Investors compete for the purchase of Bill

- Competition is carried out through the determination of the interest rate named Yield of the Treasury Bill

- The price of purchasing the Treasury Bill is calculated based on the Yield of the Treasury Bill

How is the interest earned on Treasury Bills calculated?

The interest earned on Treasury Bills is earned after the end of the maturity period.

- The interest earned is calculated as the difference between the price of the purchase and the nominal value of the Bill.

- The return rate indicates the difference ratio of the interest to the purchase price calculated on an annual basis.

- Treasury Bills can be purchased or sold before the period of maturity and traded up to 1 day before the period of maturity through licensed entities, including commercial banks.

How is the interest earned on Government Bonds calculated?

The interest earned in the form of a coupon is paid every 6 months during the duration of the instrument. Generally, Bonds are issued with a fixed coupon, i.e., a fixed interest rate throughout the duration of the Bond. Individuals may participate in bond auctions only through entities licensed for this service.

For further information on the auctions and participation in the main auction, click the link here.

Frequently Asked Questions

Here, you can find answers to the most frequently asked questions.

Treasury bills are short-term securities that mature (end) in less than a year from the date of their release to the market. They are rated by maturity: 3 months, 6 months, and 1 year. Treasury bills are purchased at a price that is lower than their nominal value at maturity. When they mature, the Government pays their nominal value. The interest received from them represents the difference between the purchase price and the nominal price that the Government pays on the maturity date.

Treasury bonds are medium- and long-term financial instruments with maturities of 2, 3, 5, and 7 years.

The interest earned in the form of a coupon is paid every 6 months during the duration of the instrument. Generally, Bonds are rated with fixed coupons, i.e., one fixed interest rate for the duration of the Bond.

Link for the announcement of auctions for participation in the primary auction.

- Through the Primary Market: Clients, through banks that are Primary Actors, can buy Government Securities directly at the auction.

- Through the Secondary market, Clients who are holders of Government Securities can trade them among themselves.

In both cases, the transaction must be carried out through banks that are the Primary Actors.

Why Raiffeisen Bank?

There are many reasons why Raiffeisen Bank is the right partner when choosing a credit card. These are the main advantages:

130 years of banking tradition

Raiffeisen Bank in Kosovo is part of Raiffeisen Bank International, carrying the same values as the parent company. Raiffeisen stands for security and stability.

The largest bank in Kosovo

Raiffeisen Bank is the biggest bank in Kosovo, based on all financial indicators. This is the result of the continuous trust of our clients and our commitment to providing the best services.

Innovation and support

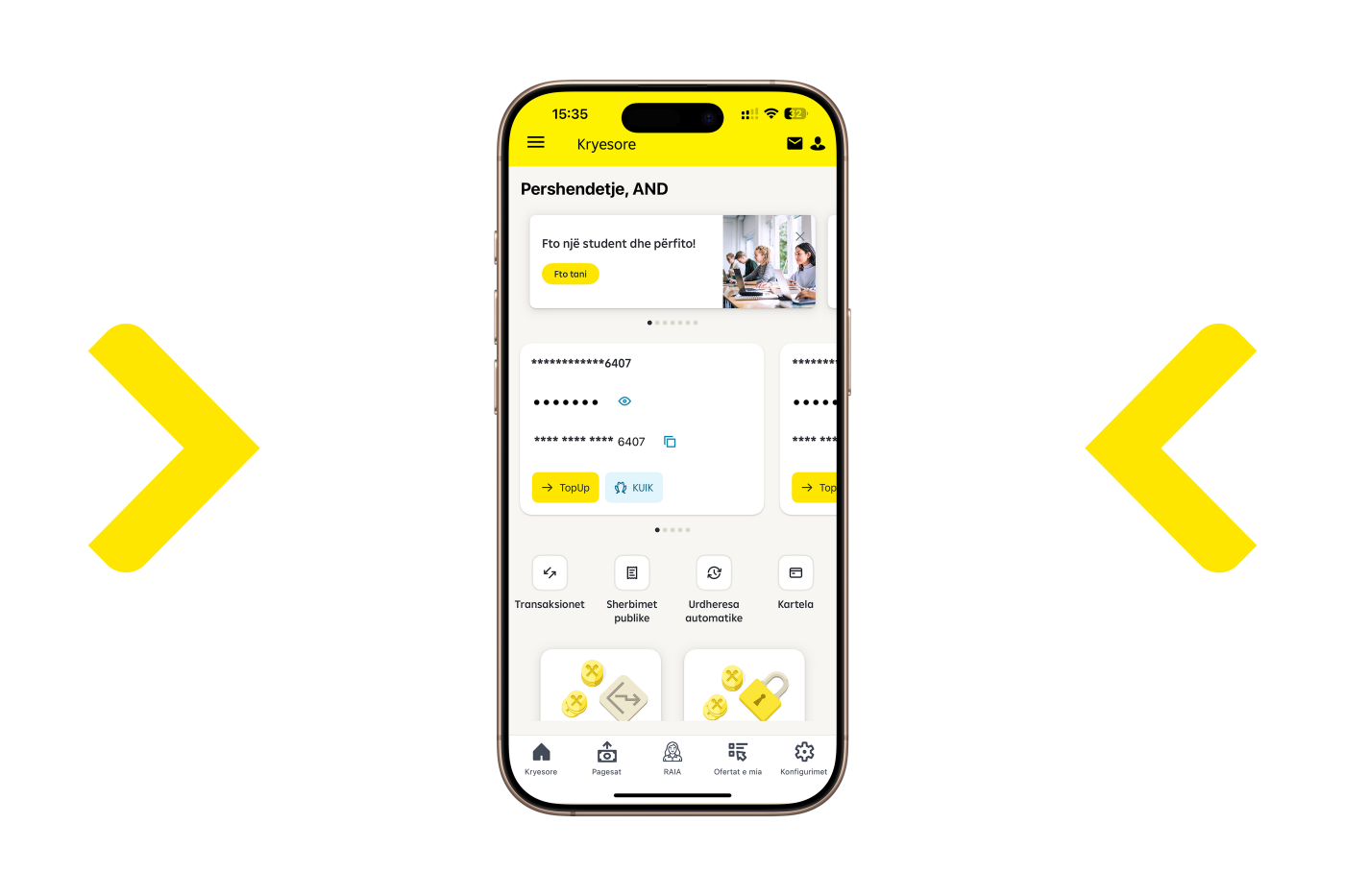

We rely on continuous innovation to provide you with an easy and stress-free banking experience. With the largest branch network and advanced digital platforms, we are with you 24/7.